The digital gold rush is on, and pickaxes have been replaced by silicon. We’re talking about cryptocurrency mining, a high-stakes game where the right hardware can mean the difference between striking it rich and ending up with nothing but a hefty electricity bill. The landscape is ever-shifting, with new algorithms, fluctuating coin values, and a constant arms race in processing power. Diving into the world of mining hardware is like navigating a complex labyrinth – price points vary wildly, performance benchmarks are crucial, and the return on investment is far from guaranteed.

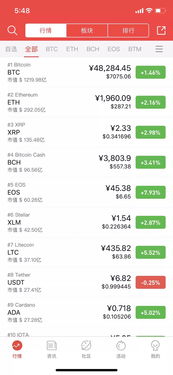

Let’s address the elephant in the server room: Bitcoin. The granddaddy of cryptocurrency, Bitcoin mining has evolved into a highly specialized field dominated by Application-Specific Integrated Circuits (ASICs). These aren’t your everyday graphics cards; they’re purpose-built machines designed to solve the complex cryptographic puzzles that secure the Bitcoin network. Think of them as finely tuned calculators, only instead of balancing your checkbook, they’re crunching hashes at breakneck speed. However, the initial investment for an ASIC miner can be substantial, often running into the thousands of dollars. Furthermore, the Bitcoin network difficulty adjusts constantly, meaning older ASICs become obsolete relatively quickly. Price vs. Performance? In the Bitcoin arena, it’s a relentless pursuit of efficiency, measured in terahashes per second (TH/s) per dollar.

Then there’s Ethereum, or rather, what *was* Ethereum mining. With the shift to Proof-of-Stake (PoS), the GPU mining frenzy for ETH has largely subsided. But that doesn’t mean the story ends there. Many other cryptocurrencies, often referred to as altcoins, still rely on Proof-of-Work (PoW) algorithms that are well-suited to GPU mining. These include coins like Ethereum Classic, Ravencoin, and many others. GPU mining offers more flexibility than ASIC mining. A single mining rig can be configured to mine different coins, allowing miners to adapt to changing market conditions and profitability. This versatility comes at a cost: GPUs typically consume more power than ASICs for the same hash rate, and the return on investment can be more variable.

Beyond the hardware itself, consider the environmental factors. Heat dissipation is a major concern. Mining rigs generate a significant amount of heat, which can impact performance and lifespan. Proper ventilation and cooling systems are essential. Power consumption is another critical factor. Electricity costs can quickly eat into profits, especially in regions with high energy prices. Mining farms, large-scale operations with rows upon rows of mining rigs, often seek out locations with cheap and abundant electricity, sometimes even setting up shop near renewable energy sources to minimize their carbon footprint.

The allure of mining extends beyond Bitcoin and Ethereum. Dogecoin, the meme-inspired cryptocurrency, also utilizes a Proof-of-Work algorithm, although its mining is often merged with Litecoin mining. This means that miners can mine both coins simultaneously, increasing their potential rewards. The algorithm used by Dogecoin is less computationally intensive than Bitcoin’s, meaning it can be mined with less powerful hardware. However, the rewards are also typically lower, reflecting the coin’s lower market capitalization.

Choosing the right mining hardware is a balancing act. It’s about weighing the upfront cost of the equipment against its hash rate, power consumption, and the potential profitability of the coins being mined. It’s also about considering the long-term implications, such as the lifespan of the hardware and the ever-changing dynamics of the cryptocurrency market. Mining machine hosting services offer a solution for those who want to participate in the mining game without the hassle of managing their own hardware. These services provide the infrastructure, including power, cooling, and maintenance, allowing miners to focus on optimizing their mining strategies.

Price vs. Performance is not a static equation. It’s a dynamic calculation that requires constant monitoring and adaptation. The most profitable mining hardware today might be obsolete tomorrow. The key to success lies in staying informed, understanding the market trends, and making informed decisions based on data and analysis. So, whether you’re building a custom mining rig in your garage or investing in a large-scale mining operation, remember that knowledge is your most valuable asset in this ever-evolving digital frontier.