In the evolving landscape of cryptocurrency mining, the debate between traditional setups and low-energy hosting solutions has gained momentum. Mining machines — the beating heart of crypto mining — have become increasingly sophisticated, driving a surge in global hash rates but also escalating energy consumption. For companies specializing in selling mining rigs and hosting these behemoths, understanding this dichotomy is vital. The question isn’t just about which machine hashes faster; it’s about how to maximize efficiency, reduce energy footprints, and ultimately optimize profitability.

The traditional approach involves miners purchasing their own high-powered hardware—ASIC miners for Bitcoin (BTC), GPU rigs for Ethereum (ETH), or even specialized equipment for altcoins like Dogecoin (DOG). These miners are then responsible for setting up, maintaining, and powering their rigs in home environments or small-scale warehouses. While this model offers control and potential savings, it comes with challenges: rising electricity costs, cooling inefficiencies, and maintenance headaches that can eat into profits.

Enter the low-energy hosting concept—a game-changer for miners who seek hassle-free, eco-conscious solutions. Mining machine hosting providers offer state-of-the-art facilities designed to house and power rigs in optimized environments. Many utilize renewable energy sources and advanced cooling methods such as immersion cooling or liquid cooling to minimize energy wastage. These farms can accommodate hundreds to thousands of mining rigs simultaneously, connecting clients to high-speed internet and ensuring uptime with robust infrastructure.

What makes hosting services especially appealing is the effortless scalability. Miners can dial up or down their hash power without worrying about physical hardware logistics. For Bitcoin, which demands highly efficient ASIC miners to stay profitable, hosting in energy-optimized farms can dramatically reduce the cost per terahash. Ethereum miners running GPU rigs also reap benefits, as energy-efficient hosting can mitigate the high electricity demands that often make ETH mining marginally profitable, especially before the merge that transitioned Ethereum to proof-of-stake.

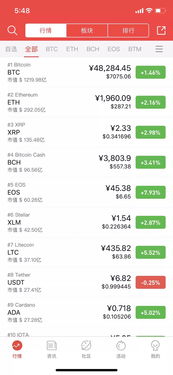

Cryptocurrency exchanges have also noticed the impact of these dual mining paradigms. The supply of freshly mined coins—whether BTC, DOG, or ETH—depends not only on market demand but also on mining economics shaped by setup types. Traditional miners might be more sensitive to price swings given their higher operational costs, whereas those using low-energy hosted solutions enjoy more predictable margins. As exchanges integrate staking and liquidity mining with traditional coin trading, the interplay between mined supply and demand dynamics becomes more complex and fascinating.

Furthermore, specialized miners—companies and individuals deeply embedded in the mining ecosystem—often leverage hosting platforms to diversify their portfolios across multiple coins. By placing mining rigs dedicated to BTC, ETH, and even DOG in tailoring hosting environments, they optimize hash rate delivery across blockchains. This multi-algorithm mining approach can hedge against volatility in a single currency and tap into various reward structures offered by different coin protocols.

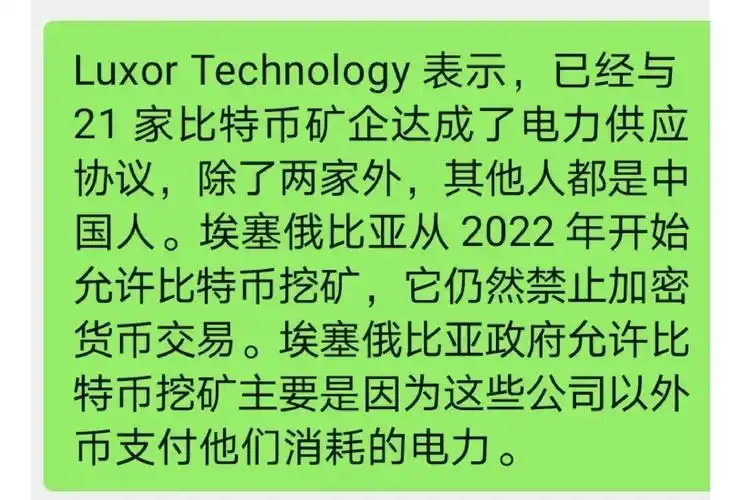

However, low-energy hosting isn’t without its nuances. Entrusting your mining machines to third-party operators means less hands-on control and reliance on their operational competence. The pricing models often include hosting fees, electricity charges, and maintenance costs, which, while typically balanced by savings in energy efficiency, need careful evaluation. Additionally, regulatory frameworks around energy use and data center operation in various jurisdictions add layers of complexity for large-scale mining farms.

Looking ahead, innovations continue to reshape the crypto mining terrain. Bitcoin miners are exploring cutting-edge ASICs designed for lower power consumption without compromising hash power. Ethereum’s pivot away from proof-of-work reduces traditional GPU mining but opens doors for hosts to repurpose rigs for other coins or DeFi-related computational tasks. Even altcoins like Dogecoin, often mined concurrently with Litecoin through merged mining, present unique hosting considerations based on algorithm compatibility and energy profiles.

The bottom line for companies involved in the sale and hosting of mining machines is that optimizing crypto mining today demands a delicate balancing act. It involves combining hardware capabilities with eco-friendly energy practices, operational scalability, and market savvy. Embracing low-energy hosting solutions can unlock enhanced profitability while contributing to the sustainability challenges haunting the crypto space. On the other hand, traditional setups may retain appeal for miners valuing maximal autonomy or constrained by local regulations and resources.

In conclusion, whether one gravitates toward traditional setups or low-energy hosting, the crypto mining ecosystem is richer and more vibrant for this diversity. Companies offering mining rigs and hosting solutions must stay agile—adapting to new technologies, fluctuating energy markets, and evolving cryptoeconomic models—to ensure miners reap maximum rewards in an increasingly competitive digital gold rush.